Every day we meet with many business owners who have no idea how the company is doing financially. Many owners don’t know what their profitability is, and the only number they see on financial reports are total revenue dollars. Only focusing on revenue can lead you to go out of business without understanding the profitability of your company.

Gross margin can provide a better understanding of how profitable your company’s operations are, and it will also help you make informed decisions about how to improve your net profit. In this blog post, we’ll talk about gross margins in detail and why they’re important for any business owner looking to grow their company!

Gross margin can provide a better understanding of how profitable your company’s operations are, and it will also help you make informed decisions about how to improve your net profit. In this blog post, we’ll talk about gross margins in detail and why they’re important for any business owner looking to grow their company!

What is gross profit margin?

Gross Margin is the difference between a company’s net sales and production costs. This number can be used by businesses as an initial indicator to measure how profitable they are.

It takes into account both their costs of goods sold (COGS) as well those indirect expenses such training staff and research efforts that may have been incurred in producing these products or services.

What’s the difference between gross margin and net profit margin?

Gross margin tells you more about the product and the costs associated with making it or acquiring the product.

The net profit margin tells you more about your business strategy. How is the business doing as a whole with all expenses factored in?

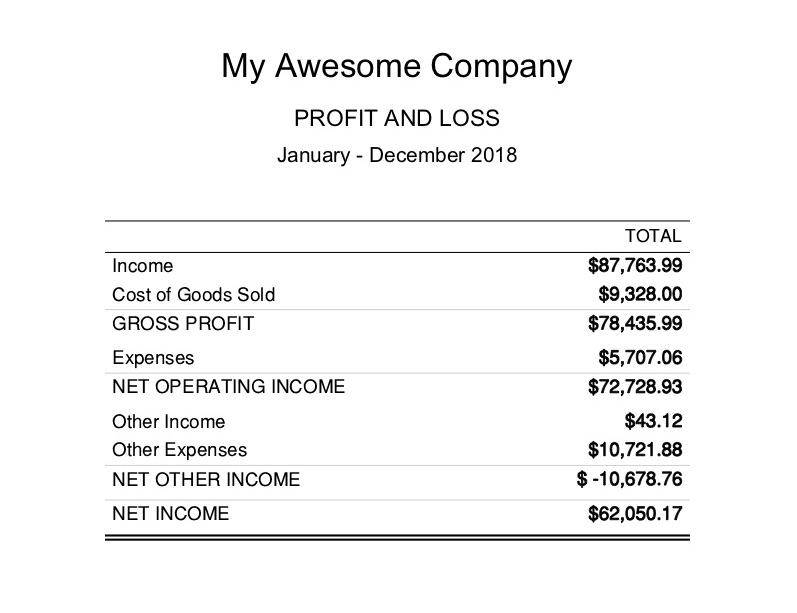

Most profit and loss statements are a massive mess of lines and explanations which only adds to the confusion. To really understand where gross margin lives, we need to keep things simple. Here is one of the most simple profit and loss statements I could find online.

It is very simple, but that is what we want so you can see the difference between when gross margin is calculated and when net margin is calculated.

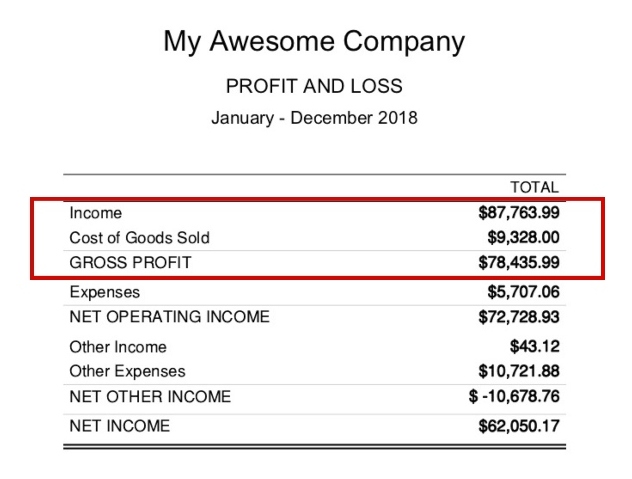

Gross Margin is First

Gross margin only takes into account what goes on in terms if production (COGS). You are going to find gross profit at the top of your income statement or profit and loss statement.

The formula is simply Income – Cost of Goods Sold = Gross Profit.

In this case, My Awesome Company has a Gross Profit of $78,435.99.

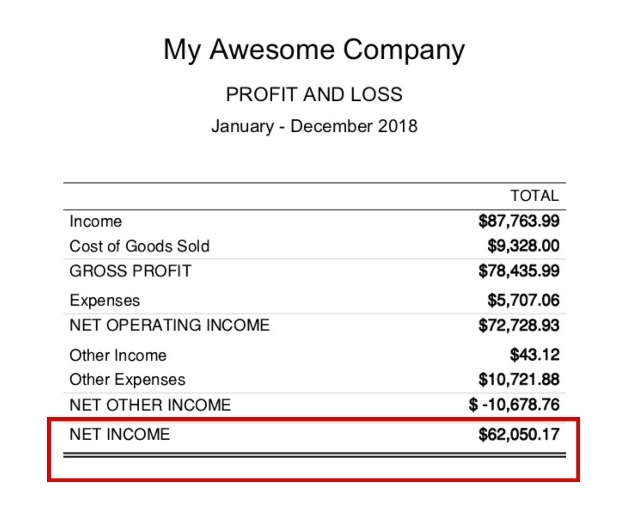

Net Income (or Net Margin) Is Last

Net Income is going to be the very last item on your profit and loss statement. This is simply everything leftover after you have made or purchased the product, paid for the facility to make it or house it and anything else that may come across as a cost.

In this case, you can see that after all the expenses are paid, My Awesome Company is showing Net Income of $62,050.17.

Importance of understanding gross profit

If you are looking for your business to become more profitable, taking a hard look at all the costs that go into your product should be at the top of your list. Any efforts to improve efficiency of production will benefit your overall profitability, net profit.

If a company’s COGs exceed its revenues or if prices on goods offered by your company don’t cover all manufacturing expenses associated with making them, you won’t be in business very long!

However, if you are looking for growth in your business, understanding gross margins can help you identify areas where future investment would be most effective. Even a small percentage increase in gross margin can mean more cash for investment in your business or a bigger paycheck for you, the Owner.

What is a good gross margin?

It depends of course on what type of business your in, where you are located and a host of other defining characteristics of your business. Purchasing some research for your business is one of the easiest ways to find out what your gross profit margin should be.

Most research identifies actual businesses in the same industry. Those businesses usually share financial data so it is a good place to start.

Low gross margin?

A low gross margin percentage does not mean that your business is doing poorly. You must understand what the typical ratios are for your business industry.

For example, a service business such as accounting or consulting will have much lower gross margins than other businesses. If you own an ice cream shop the same applies!

Even if your industry has average gross margin ratios of say 20%, it doesn’t mean that yours should be the same and vice versa.

What should your gross margin be?

There is no right answer to what your overall margin should be since it depends on many other factors such as industry and competition but the goal is always to become more efficient at producing better quality products for less money. While using others for benchmarks is a great way to get in the ballpark, you have to focus on your own operations to make any improvements to either the gross profit or net profit.

How can you increase your gross marketing percentage?

It all starts with analyzing and truly understanding your businesses financial benchmarks. Spending time doing analysis and reviewing spreadsheets is not on most business owners favorite things to do list. Since it is not one of the most exciting parts of the business, most business owners only put attention toward the financials when there is a negative variance.

They react to what has already happened vs being proactive and correcting the negative variances and problems as they occur rather than waiting. Let’s look at the difference between a business that is reactive vs a business that is proactive.

Proactive vs reactive financial management

Increasing your gross profits begins with how you approach reviewing your business financials. The most common approach to managing the gross margin that we see in most small businesses is the “wait and see” approach to financial management.

What is the “wait and see” approach (Reactive) ?

This is simply reviewing your financials once a month, typically after 10th of the month to see if you have increased the gross margin. While this may work at times, it will usually falls short because by the time the 10th of the month comes around, 1/3 of the next month is already gone.

If you are one of those owners that only reviews your financials at tax time, you are truly missing out on the opportunity to increase your overall profitability.

Forecasting and planning approach (Proactive)

If you are serious about improving gross profit margins, it starts with planning and forecasting. It requires a reflective approach of what you have done historically (accounting history) and where you want to go (financial forecasting) in the future.

You have to be practical. It is not reasonable to think that if your business has had a gross margin of 26% for the past 5 years that you can move that to 34% in the next 6 months. It will surely not happen with the wait and see approach. Planning for what you want is the only way to increase profitability.

Profit Pro mentors business owners on proactive financial management

Financial management is another one of the many hats that most business owners where when operating a business. It can be difficult and quite frankly is confusing to most business owners.

Profit Pro has a 6 step approach to help you better understand and plan for the gross profit margin (and net profit) of your business.

Step 1 – Analyze the Profit and Loss Statements

It is important to review your profit and loss statement to determine the areas that are not meeting your goals. In most cases, you should look at sales numbers, labor and material, gross profit, overhead, expenses and net profit.

You may need to spend some time going back 1 year, 3 years or maybe 5 years depending on your business. This will help identify your trendlines.

Once you have isolated the areas that are struggling, develop a schedule and action plan to identify the department(s) responsible through the correct Process.

Step 2 – Document Your Financial Processes

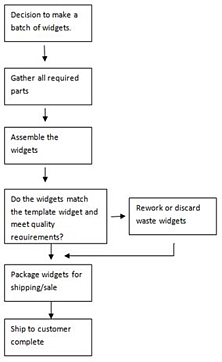

Once the area has been identified and the goal is set, gather a team of people to document all the processes within the struggling function. You must then create a process map of all of those steps.

While the above diagram is a very simplified process illustration, process mapping helps you identify what is done, who is responsible, to what standard should a job be completed, and how successful the process is.

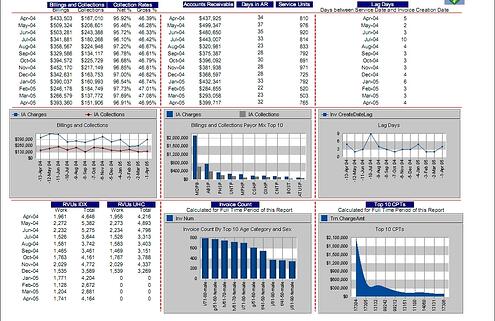

Step 3 – Setup Critical Indicator Reporting

Once the process is documented, we identify those functions within the process that are critical to the overall success. Then you need to set a goal for each of those areas and list them on a document for the department manager to review weekly.

See below for an example of an Indicator Report

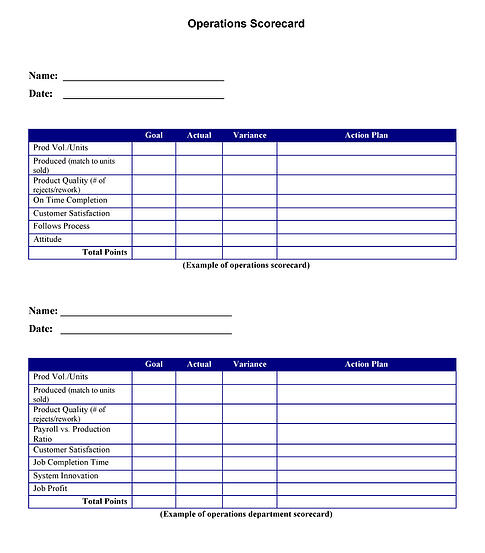

Step 4 – Develop Custom Scorecards for Your Business

Scorecarding is an effective proactive strategy to increase overall profitability. The Indicator Report measurements should then be passed into the workforce through Scorecarding.

Each employee is responsible for measuring their actions within the daily process. This information would then be fed back to the Department Manager to populate the Indicator Report.

Below you will find an example of our Operations Scorecard. Since every business has its own unique DNA, we use customizable scorecards to fit your needs.

Step 5 – Budget vs Actual = Variance

Once the scorecards are completed, they should be fed back into the Indicator Report. The numbers must be compiled and reviewed by the Department Managers (budget versus actual). By creating budgets (or goals) to measure, you immediately know where problems exist in the business.

Step 6 – Create Action Plans to Correct Variance

When a variance is identified from goal, an action plan needs to be developed to fix the variance. The action plan could be tweaking the process or training the personnel. The Indicator Report then gets funneled back to the Profit and Loss Statement.

Can you see the difference?

By being proactive with the Profit and Loss Statement you are able to monitor your numbers daily and weekly… instead of after the statement is published. This 6 step process give you laser focus on where to put your energies. No guessing.

You can directly focus and affect those areas that are chipping away at successful strategies. Bottom line, the goal is to increase the net profit. By having the Profit Pro system in place, your profit is now planned ahead and predictable rather than just taking what you get at the end of the year. This system allows you to make adjustments and correct problems as they occur.

Your newfound profitability can either be invested into your company or you can take a bigger paycheck. It all depends on your goals and objectives.

Seems too overwhelming?

Profit Pro has helped hundreds of companies with this very same financial management process. It is only one of many templated financial management solutions that Profit Pro makes available to you through our consulting practice. Each one of our templates is customized to your business with a trained experienced consultant.

Book a call today to review your Financial Management processes.