Defining profit is an important part of any business. Profit helps to measure the success of your business and will help you understand how well it is doing in the market.

There are many ways to define profit with some being better than others depending on what you want to do with that information.

To start off, let’s discuss why defining profit matters for your business!

What is profit margin?

Net profits are a measure of the company’s financial success. They represent earnings that exceed both necessary expenditures and can be used to increase business productivity by reducing costs for future investments or expansion projects.

A profitable organization will have greater opportunities than an unprofitable one because it has more disposable income available each year which means they’re able invest in themselves instead of relying on outside investors or creditors.

As a business owner, defining profit is important because it gives you insight into how well your company is doing and what areas need improvement to make the most of your money.

Why did you start your business?

Have you ever really taken the time to think about why you started your business? It can be for a variety of reasons, but most importantly, you have to decide what you want from your business. What we see most everyday is that most businesses are simply treated as a job. There is nothing wrong with that, however, if you are in that crowd, then profit is usually at the bottom of your list of priorities.

There really are only 2 types of business mindsets:

- Technician mindset, A business that provides a job for the owners

- Investor mindset, A business that is treated like an investment

The Technician mindset…Is your business just a job?

Many business owners got into business because they were very good at providing a service or creating a product. When business owners treat their business as a job, profit is rarely an important factor in the ongoing operations of the business. When business owners do not include profit as an important factor, they are often operating their businesses at a loss.

Every person has their own reason for starting a company which is why measuring your profit margin can be helpful. By knowing your profit margin you can see whether or not the company is staying afloat. Whether it’s at a loss, breaking even, or making profits!

The Investor mindset…Is your business an investment?

If you have an Investor mindset, you likely started your business based on profit motive. Above all else, profit is your top priority. Profit motive is a powerful force in the economy, and it’s been influential for centuries.

What does profit mean?

The basic formula for calculating profit is by subtracting expenses incurred during a period from the total revenue earned in that same account. Profits are reported below each figure on an income statement and traditionally regarded as how much money remains after all these costs have been paid off.

If there isn’t enough profit left over with revenues exceeding those expenditures, then no negative profits exist – instead companies should report net losses showing where insufficient amounts were made available to cover up any remaining obligations throughout last year’s timeframe (or longer).

What does profit tell you?

Profit is the money that a company makes after taking into account all other expenses. There are three main types of profits – gross, operating and net; each type provides most businesses with more detailed information about performance compared to time periods or competitors.

Calculating profit will provide different perspectives on how well business activity has gone since last month, last quarter or last year.

Possibly the most compelling point to note is that profit margins are not necessarily a reflection of how well a company has done in recent years. For example, both Apple and General Motors have experienced periods where their profits were low but they stayed afloat because their revenues were high enough to cover those losses. In this sense it can be said that profit margins are misleading.

The 3 types of profit; gross profit, operating profit, net profit

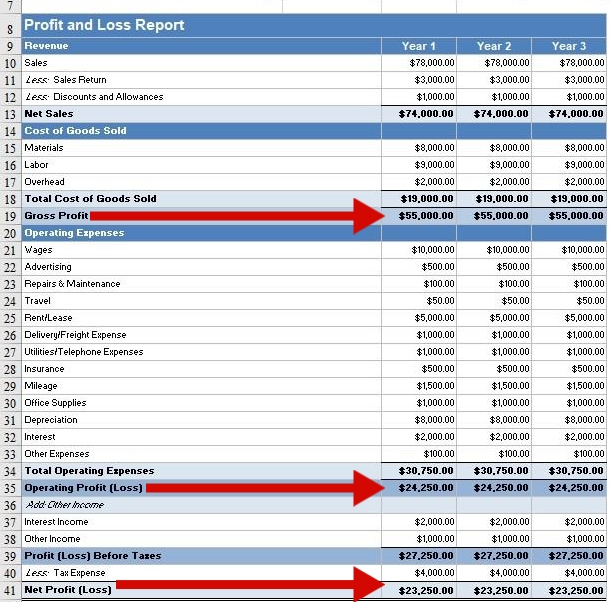

The income statement (also referred to as profit and loss statement) is one of the most critical tools for helping you identify your profit dollars based on your company’s performance. All three of the profit types are represented on your accounting financial statements.

You may have to do some digging to match up each of the three based on your format that is provided by your internal or external accounting professionals. There are numerous formats for income statements depending on the type of business you are in.

Here is one example of a Profit and Loss Report, Statement or also referred to as an Income Statement:

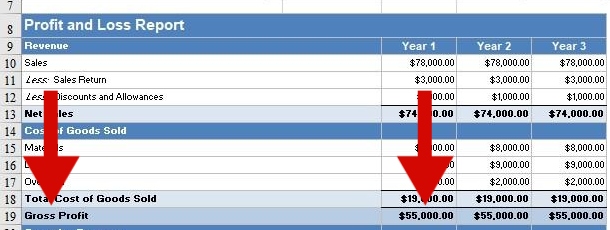

What is gross profit?

Gross profit is the difference between a company’s net sales revenue and variable costs. The following formula for gross margin looks like this:

Total Sales – COGS (Cost of goods sold) = Gross Profit

A business’s goal should be to maximize its gross profit by reducing both direct expenses (those that are directly related to producing one product) such as salaries or rent, as well any indirect expenditures which includes things like electricity usage because they affect other parts of our business without providing value added output.

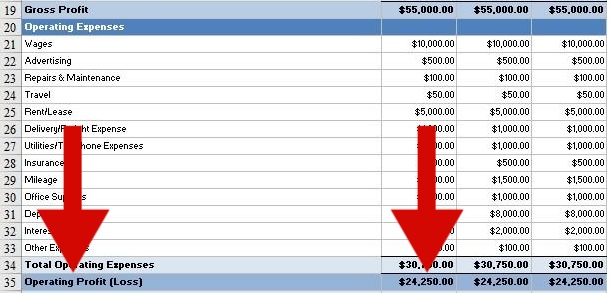

What is operating profit?

Operating profit (also referred to as operating income) shows the percentage of revenue left over after direct costs, but before interest and taxation expenses. It tells a business owner how much money a business has to cover its overhead (indirect) costs , which are those that cannot be directly traced to one product or service .

Operating profit margins can serve as a useful proxy for a business’s long-term profit potential because many indirect expenses, such as research and development or administration costs, are fixed in nature.

These types of expenditures can be considered ‘overhead’ which is essential to keep the lights on but not actually directly related to producing one product/service. If those overhead costs increase without a corresponding increase in revenue then it is likely the company will experience lower profits.

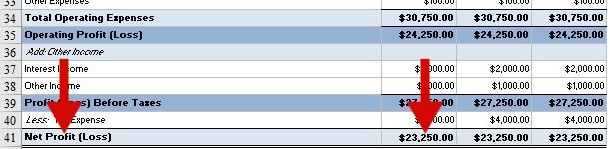

What is net profit ?

Net profit (also referred to as net income) reflects the value added by a business after it has paid for all of its operating expenses , including indirect costs such as rent, utilities, insurance premiums and administrative costs.

It’s called ‘net’ because it is derived from revenue less direct (variable) expense AND non-operating expenditures such as interest and income taxes.

In other words, net profit is the amount of money left over after a company has paid both operating expenses AND everything it owes in terms of debts.

In essence your ‘bottom line’ aka Net Profit represents how much value you have added/generated during any given time period. In the end it is important to note that all three types of profit should be included in a company’s annual reports and financial statements as they provide unique insight into how well a business is doing from year to year, quarter by quarter.

Having this information at hand helps business owners, investors and analysts to determine how healthy a company actually is.

Two potential ways to increase profits

1. Reduce costs

Reducing costs is a good thing, and lowering the company’s total expenses can be beneficial in many ways.

For example:

- Companies are more efficient with greater competitive advantage

- It improves services for customers while reacting faster which could lead them to expand profits and business

- It could lead to greater investment in the company’s growth and development.

However, what is more important than just cutting total expenses is having a clearly defined strategy for making every dollar count . In other words, businesses need to generate profits , which means finding ways of increasing revenue while at the same time minimizing expenditures or losses.

2. Increase sales revenue

A business can increase sales revenue to boost profits. This typically leads to raising prices. However, raising prices can a delicate balancing act. When you raise your prices, you will likely lose some customers. But those that do stay will be more profitable than they have been in the past. Losing too many customers can be counter productive which is why it is critical to understand your competition and the value your business brings to the product or service.

For example, if you are an accountant charging $50/hour and your competitors charge $40 it is possible to increase prices by 20% (an additional $20) which might be enough of incentive for customers to switch. However this will only work if the service that you provide has more value than what your competitor offers.

That’s why it’s extremely important to know what your customers want and how you can provide a service that is more valuable than the competition.

How can Profit Pro help you to better define your profit?

The experts at Profit Pro Consulting act as your Chief Financial Officer. In this position, Profit Pro develops a financial strategy that guides your business to where the business owner wants to go.

We never replace your internal or external Accounting professionals. They are a critical component to any successful financial strategy. We simply provide the structure to ensure you as the owner are hitting the goals that you have established. Profits must be at the top of that list because without it, it’s difficult to make any measurable progress toward goals.

Financial Management Systems and Strategy

Profits should and always will be number one concern for any business owner. In order to create and accurately track profits, several key financial management systems must be in place:

- Corporate strategic objective (1-5 years) Also See Management Systems

- Sales forecasting system

- Budgets for each department

- Profit planning system

- Growth plans to obtain increased financial capabilities

- Cash flow plans

- Document management and control systems

- Conversion cycle of assets, turnover

- Terms of sales

- Accounts receivables management systems

- Accounts payables management systems

- Job profit analysis systems

- Product or service analysis

- Personnel cost calculation systems

What systems you need depends on a variety of factors. TheProfit Pro Financial Management system is a templated system to get your financial management systems in place. Without it, you will likely not reach your profit goals now or in the future.